Investments

Mission Aligned Investing

Mission aligned investing (also called values aligned investing or impact investing) is the practice of aligning a foundation’s investments with their values or mission. These values can include environmental interests, religious beliefs, and social justice. Mission aligned investing is also a model that helps foundations maximize equity and philanthropic impact. Access fundamental terms and concepts here.

$58.4 million in assets as of December 31, 2024

Asset Allocations

Maddox legacy investments are illiquid private equity and private real estate holdings that remain with our original investment firm until they can be liquidated and mission-aligned

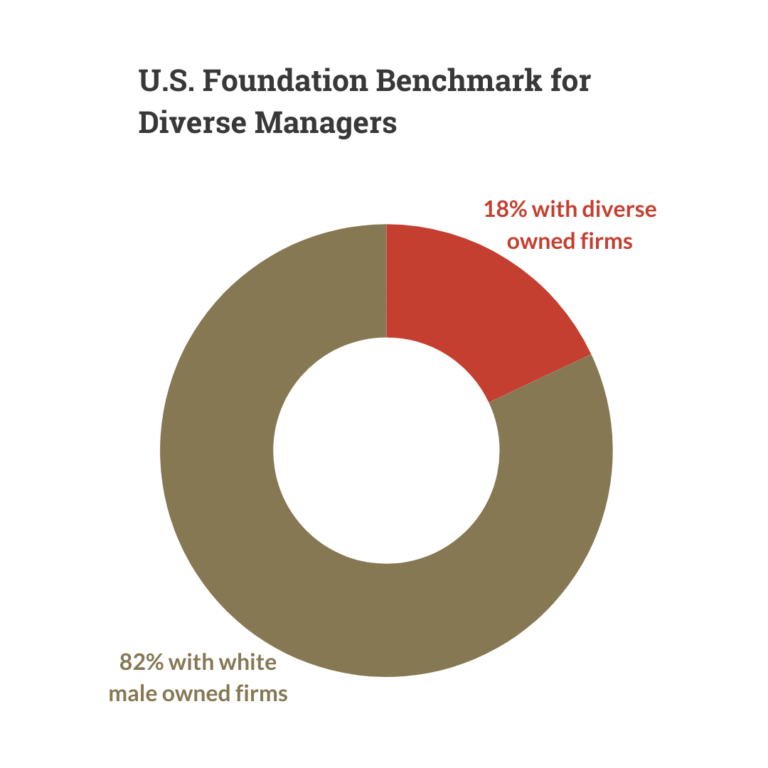

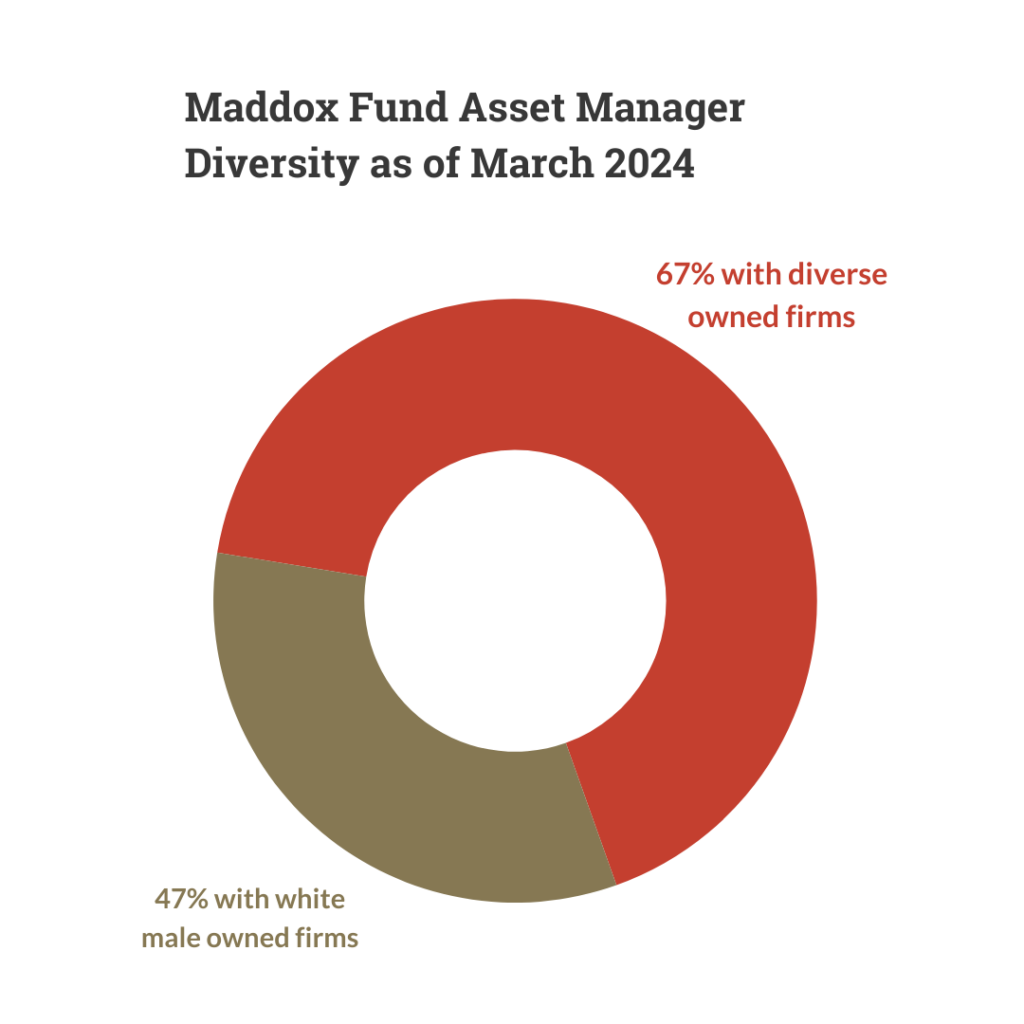

Asset Manager Diversity

Our Investment Priorities

positive screens

- Renewable Energy, low carbon impact and climate sustainability

- Investment opportunities that reduce or mitigate the effects of climate change

- Financial inclusion and capital access for disenfranchised communities

negative screens

- Private prisons

- Companies that take advantage of underserved or underrepresented populations

- Fossil fuel miners/producers and companies with significant carbon footprints

diverse managers

- Firm has a formal statement of Diversity and Inclusion and has adopted hiring policies to attract, retain, and train Black, Indigenous and People of Color, Women, and persons of underrepresented communities in the finance industry at all levels in the firm.

our investment partner

Bivium Westfuller is a full-service provider of mission-aligned Outsourced Chief Investment Officer (OCIO) solutions. We partner with leading mission-driven organizations to pursue investment performance in alignment with, not at the expense of, values. Our bespoke discretionary and non-discretionary models offer a comprehensive services, from the design and implementation of Investment Policy Statements and Strategic Asset Allocations, to selecting best-in-class managers, constructing alpha-seeking portfolios, providing comprehensive investment and impact reporting, offering a range of back-office support, and serving as an educator and thought leader partner to our clients.

Learning

The Maddox Fund’s Investment Committee is committed to learning. Here is an agenda of topics that we will cover over the next year.

- Mission Related Investments

- Program Related Investments

- Impact Reporting

- Shareholder Activism and Proxy Voting

- Risk Assessment

- Fossil Free Investing

- Net Zero/Just Transition

Here are some resources we found helpful.

In partnership with other local foundations, we have been exploring ways to utilize assets beyond the 5% IRS required payout. This group has covered different topics in 2024. Check out this playlist to see what we are learning about.